Beanstalk 🌱💵 is a credit-based stablecoin.

This FAQ will explain what Beanstalk is, why it’s important, and how you can make money using Beanstalk.

TLDR; Beanstalk uses credit instead of collateral to trustlessly issue a decentralized stablecoin with protocol-native high-APY.

The DeFi stablecoin market grew by 500% this year to ~$150 billion. Stablecoins have obviously found product market fit in DeFi, but existing stablecoins can’t scale to meet the demand (as explained in the FAQ).

Beanstalk, if successful, will dominate the stablecoin market to become the native DeFi stablecoin. In doing so, it will enable anyone to have a passive, high-yield, decentralized, USD-deposit account. The team is stellar, the protocol has proven its resilience over time, and there’s some really exciting integrations on the horizon.

Who made Beanstalk? How long has it been around?

Beanstalk Protocol is a decentralized credit-based stablecoin protocol. It was launched in August of 2021 by a group of anonymous developers and economists using the pseudonym Publius. Publius was actually the psuedonym of the authors of the Federalist Papers, including Alexander Hamilton, the first secretary of the treasury. The whitepaper begins with the following quote by Hamilton: “A national debt if it is not excessive will be to us a national blessing; it will be powerful cement of our union.”

This is the key insight of Beanstalk. A decentralized, credit-based stablecoin is far superior to a collateralized stablecoin because (1) it is resistant to regulation & other centralized failure modes and (2) as demand for Beans grows, instead of scale penalizing users with negative carry costs, the growth of Beanstalk benefits users by distributing a yield back to anyone who is staking Beans.

Why can’t existing stablecoins scale? Or, why are credit-based stablecoins better than collateralized ones?

The simple reason is because there is not enough collateral to meet the demand for stablecoins (remember, stablecoin supply is up 500% this year and growing). Consider, why aren’t there hundreds of billions of dollars of DAI?

All existing stablecoins have some element of collateral. And there simply isn’t enough collateral (on-chain or off-chain) to collateralize hundreds of billions more dollars of stablecoin assets, like USDC and USDT.

This lack of collateral means that there is a huge shortage of stablecoins in DeFi today compared to the demand. Basic economics tells us that when you have a shortage of supply, you get a higher price. That “higher price” shows up in the borrowing and lending costs which are now almost 10%(!) and rising.

To summarize, collateralized stablecoins can’t scale because of a lack of collateral (both digital and fiat/physical). This translates to limited supply, and high borrowing/lending rates.

When you flip from a collateral-based to a credit-based model you change from a supply shortage & negative borrowing costs to 0 borrowing costs and positive yield to holders.

This positive carry shows up in the Beanstalk-native APY which is currently ~600%.

Beanstalk’s credit-based model upends DeFi because if you have an ETH wallet, you have access to a passive, high-yield, USD deposit account.

Okay, so how exactly does Beanstalk work?

For the detailed explanation, I would recommend the whitepaper, but the TLDR on “How Beanstalk Works” is summarized nicely in this graphic below. Though it looks a bit complex at first, it’s actually quite a simple and robust system, designed to innovate on the previous attempts of projects like ESD and Basis Cash.

Beanstalk uses a decentralized set of incentives that the system uses to continually oscillate the price of 1 $BEAN to $1.00USD. Users are able to do things like buy Beans, transfer Beans, Silo (“stake”) Beans, and lend debt to Beanstalk. All of these different actions, done by rational or irrational actors, ensure that Beanstalk keeps its $1.00 peg more & more tightly over time. The protocol updates different variables every “Season” (1 hour) to incentivize these different actions.

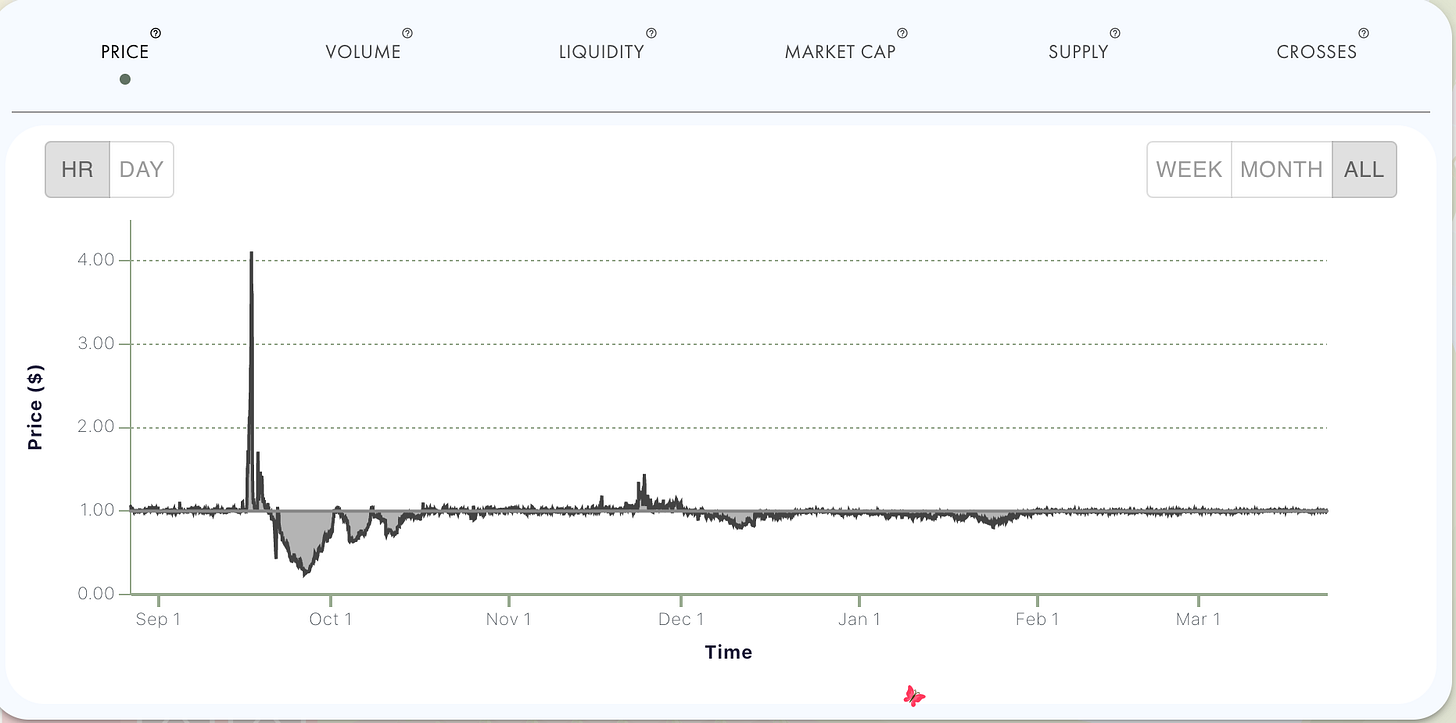

As the system is buffeted by shocks, pumps, and sell-offs it actually _benefits_ the Beanstalk Protocol by making it more resilient and furthers trust in the system. Beanstalk has paid back over $22M+ of debt and the price is hovering right around its $1 peg.

The proof, as they say, is in the pudding. Here is the Beanstalk all-time price graph:

The simple way to understand Beanstalk is that any time the price of 1 Bean is over $1.00, Beanstalk Protocol prints more Beans to increase the supply, and in doing so bring the price back to $1.00. The new Beans produced by Beanstalk are split 50/50 between (1) Beans that are “staked” in the Silo and (2) to pay off the debt of previous Beanstalk creditors. As demand for Bean increases, the debt is paid off more quickly, and the APY’s on Silo’ing rise.

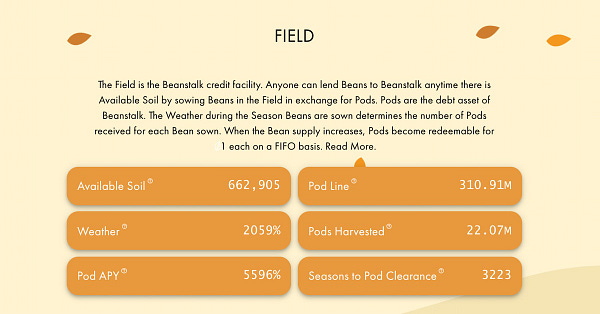

When the price of 1 Bean is _below_ $1.00, Beanstalk issues debt that allows people to burn Beans today to reduce the supply and increase the price back to $1.00. In exchange, you get a debt coupon at a market set interest rate. Using the mechanism described above, that debt is paid off over time in a first in, first out manner. This is especially cool because this “First In, First Out” mechanism is trustlessly verifiable on the blockchain, something that’s not possible in traditional finance.

Sounds great. So how do I make money with Beanstalk?

The two primary ways to profit from Beanstalk are by buying equity in Beanstalk or buying debt from Beanstalk.

You get equity (called “Stalk” - get it? Beans, Stalk? ;) ) by “staking your Beans” in the Silo. Here’s a guide on how to do just that:

You can buy debt from Beanstalk in the Field, which is the name for the decentralized credit facility. Here’s a short guide on how to do that as well:

How does Beanstalk compare to previous algostables and other stablecoins?

Check out this guide for a comparison of Beanstalk to other major stablecoins:

Is Beanstalk a Ponzi Scheme?

No. Lenders are not lending to Beanstalk under the assumption they will get paid off because of more lending to Beanstalk in the future. This is both unsustainable and the definition of a ponzi scheme.

Beanstalk can never pay off the Pod line by attracting lenders. Instead lenders create utility in the form of Bean stability. Aka Bean holding the $1 peg.

That stability -> utility attracts a) new use cases for Beans, b) new users of Beans and c) new Silo Depositors. New demand for using Beans is what ultimately leads to Pods being harvested. So it’s not premised on a ponzi of infinite lenders, but instead in the protocol being able to hold the price at the $1.00 peg. That breeds stability, which breeds utility. Eventually the goal is to make Bean the native DeFi stablecoin.

How do I learn more about Beanstalk?

If you’d like to hear the team behind Beanstalk speak about the protocol, check out Nasjaq’s interview with the founding team (Publius) here.

I’d encourage you to listen to one or more of the recent AMA’s here.

You can join in the fun on the Discord server here.

And feel free to ask me questions directly on Twitter: https://twitter.com/bean_merchant

Bonus:

What happened during the September Pump & Dump?

Beanstalk went viral on crypto twitter and was trading at a $1. Then it 6-8M of ETH came in over a couple hours and price was pushed to $4.

This capital then quickly left Beanstalk, but once the apes who pumped it realize they couldn't exploit Beanstalk for their personal gain, they immediately left.

This pump & dump proved that Beanstalk is resistant to the inorganic demand that broke ESD, DSD, or Basis Cash because they grew too fast on the upswing.

What’s next for Beanstalk?

Stalk (governance token) becomes tradeable with Stalk & Seed Uniswap Pools

Beanstalk becomes a reserve treasury asset for many different DeFi protocols who want to earn passive stable yield.

Curve Pool in the coming weeks.

Community & DAO are growing considerably. If you’d like to contribute, send me a message on Twitter or post in #skillset-volunteer in the DAO.

Check out Nasjaq’s path to 1 billion beans here.

Happy beaning everyone,

-Bean Merchant 🌱💵